An IoT ROI Reality Check

Simple IoT ROI Reality Check

The IoT is projected to improve efficiencies in businesses and households around the world. For businesses and consumers to invest in the IoT, the money spent has to make sense. To help us ground our thinking, let’s check out a simple example calculating the ROI on a device investment. The numbers used in this example are completely hypothetical but represent the notional ideas common in the LPWA space. We’ll assume the investment can bring us a return (or savings through greater efficiency) of $5 a year after all costs are accounted for.

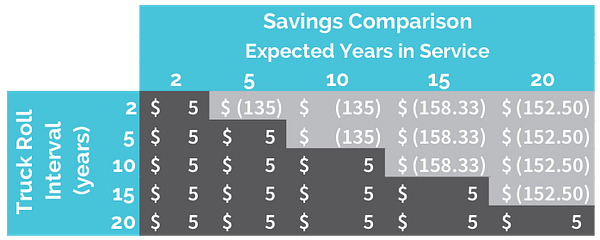

At first blush, this seems like a no-brainer investment. However, let’s take into account the longevity of the device’s technology which we will vary in this example from two to twenty years. Device life encompasses any change in condition that would require a truck roll. Truck rolls are expensive and often show up as hidden costs. Truck rolls would include replacing a battery or replacing the wireless module because the tech is sunsetting (as happens just about every decade with cellular technology). Expected years in service represents how long the device will be in service including any truck rolls needed to keep it working. Truck rolls will most likely be outsourced to a service provider. A truck roll is assumed to cost roughly $350 per device, which frankly, is conservative. A more realistic truck roll cost may be upwards of $500.

The second table shows the annual savings from owning a device with the given device and expected life cycles. The table shows that a device with truck rolls every 5 years to, say, replace a battery, and an expected service life of 15 years would have two truck rolls (one at 5 years and another at 10 years). The cells highlighted in black show the annual savings of $5 with no truck rolls. The cells in gray show the loss (negative savings) that results from needing truck rolls (because the device life cycle is shorter than the expected years in service).

What becomes clear is that truck rolls are an IoT investment killer.

In each case, the device life needs to be at least as long as the expected years in service in order to be profitable. As soon as a truck roll is required, the expected savings disappear. In order for an IoT investment to make sense it the savings have to increase 28-fold even to be considered. This result is logical, but the example helps really drive that home.

Here’s the beautiful flip side: with the longevity LPWA provides, it makes sense to invest in areas that require a much lower estimated savings per device. This is precisely how the IoT brings about the efficiencies it is proclaimed to bring.

Find out how RPMA provides the only LPWA solution with the longevity needed to pass the IoT ROI check: read our white paper, How RPMA Works.